The Ultimate Guide To How To Get Copy Of Chapter 13 Discharge Papers

Examine This Report on How To Get Copy Of Bankruptcy Discharge Papers

Table of ContentsChapter 13 Discharge Papers Can Be Fun For AnyoneThe Definitive Guide for Bankruptcy Discharge PaperworkGet This Report about Chapter 13 Discharge PapersCopy Of Chapter 7 Discharge Papers Can Be Fun For EveryoneThe Buzz on How To Get Copy Of Chapter 13 Discharge Papers

Attorney's are not needed to keep personal bankruptcy filings."Free Personal Bankruptcy Documents"A. All Firm and Organization Record, might be purchased by calling the U.S.A. Bankruptcy records insolvency documents utilize kept indefinitely maintained 2015Till Legislations have now transformed to keep insolvency data for just 20 years - https://blog.valutek.com/home/glove-selection-the-5-cs.

If you submitted bankruptcy in 2004 or prior, your documents are limited, and might not be readily available to order electronically. Telephone Call (800) 988-2448 to examine the accessibility prior to getting your documents, if this applies to you. The documents may be readily available with NARA.(a federal government agency) We do not operate in combination with NARA or any of its agents.

Some Known Details About Obtaining Copy Of Bankruptcy Discharge Papers

United state Records charge's to assist in the access procedure of acquiring insolvency documents from NARA, depends on the time involved as well as expense entailed for U.S. Records, plus NARA's fees The Docket is a register of general details throughout the insolvency. Such as condition, instance number, filing as well as discharges dates, Lawyer & Trustee information.

If you're late paying the tax, maintain the return two years from the day you paid or 3 from when you submitted (whichever is later). When it involves invoices, if there's a guarantee, keep the invoice till the warranty runs out. Or else, for anything you may require to take back, simply keep the invoice till the return duration is up.

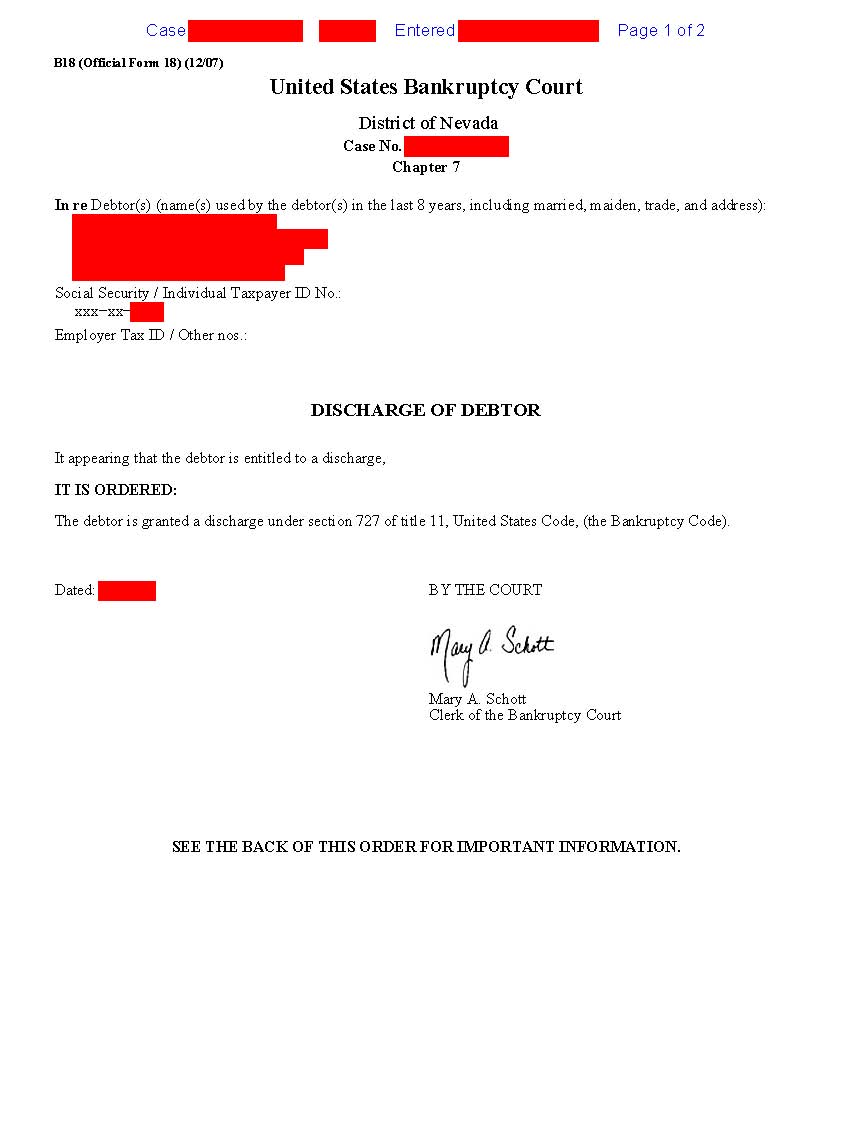

Although your bankruptcy request, records, and also discharge feel like financial records that could fall under the very same timeline as your tax obligation docs, they are NOT (how to get copy of bankruptcy discharge papers). They are much extra essential as well as need to be maintained forever. Lenders might return as well as try to gather on a debt that was component of the personal bankruptcy.

Facts About How To Obtain Bankruptcy Discharge Letter Uncovered

Creditors market off poor financial debt in pieces of thousands (or hundreds of thousands) of accounts. Uncollectable loan customers are typically hostile and also deceitful, and having your personal bankruptcy documents on-hand can be the fastest way to shut them down as well as maintain old items from popping back up on your credit score record.

Having certified duplicates of your documents can prevent a delay in your licensure. The short answer? Every one of them. Obtaining copies of your insolvency files from your attorney can take some time, particularly if your instance is older and also the duplicates are archived off-site. Obtaining personal bankruptcy records from the Federal courts can be pricey as well as taxing too (https://www.techbookmarks.com/author/b4nkrvptcydcp/).

Obtain a box or large envelope and placed them all within. Place them in a safe location, also like where you maintain your will certainly and also various other essential economic papers and also just leave them there.

How How To Get Copy Of Bankruptcy Discharge Papers can Save You Time, Stress, and Money.

A released debt actually goes away. It's no much longer collectible. The lender should write it off. Financial debts that are most likely to be discharged in a bankruptcy case consist of bank card financial debts, medical costs, some lawsuit judgments, individual fundings, responsibilities under a lease or various other contract, as well as various other unsecured debts - https://www.provenexpert.com/copy-of-bankruptcy-discharge-papers/. That could appear as well great to be true, and also there are without a doubt some disadvantages.

You have to develop to the court's complete satisfaction that the discharge is monetarily needed. You can't just ask the insolvency court to release your financial debts due to the fact that you do not wish to pay them. chapter 13 discharge papers. You should complete every one of the needs for your personal bankruptcy instance to obtain a discharge. The court can reject you a discharge if you don't take a required economic monitoring training course.

Insolvency Trustee, and the trustee's attorney. The trustee directly manages your insolvency case.

Bankruptcy Discharge Paperwork Fundamentals Explained

You can file an activity with the personal bankruptcy court to have your instance resumed if any creditor tries to accumulate a released financial debt from you. The financial institution can be fined if the court identifies that it breached the discharge order. You can try just sending a copy of your order of discharge to stop any collection activity, and afterwards talk with a bankruptcy lawyer concerning taking lawsuit if that doesn't function.

The trustee will liquidate your nonexempt possessions as well as divide the proceeds amongst your creditors in a Phase 7 insolvency. Any debt that continues to be will certainly be released or removed. You'll participate in a settlement strategy over three to 5 years that pays off all or the majority of your financial obligations if you file for Phase 13 defense.